Home Improvement Financing

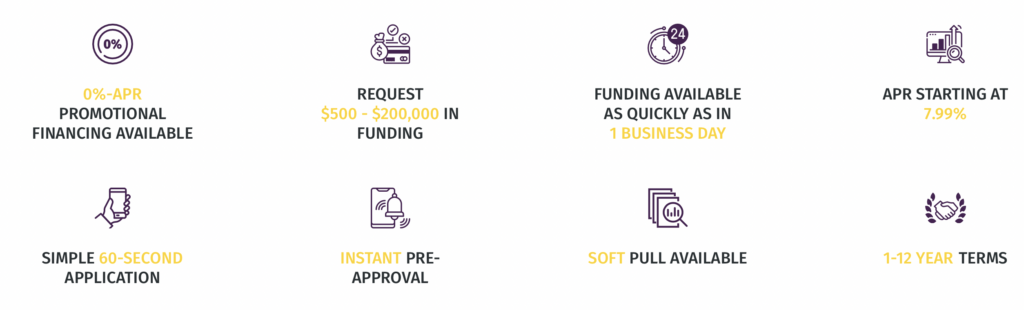

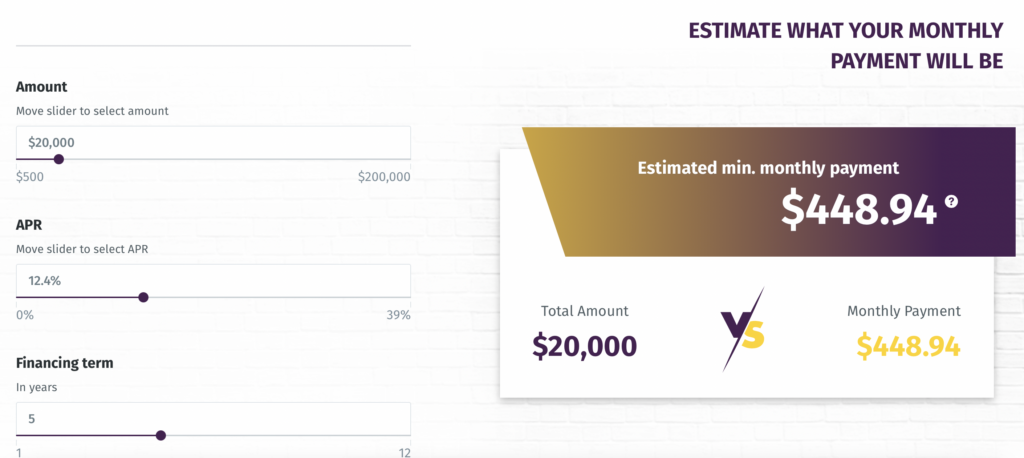

Financing home improvements is key to enhancing your property. Explore options like home equity loans and HELOCs, leveraging your home’s equity for potentially lower rates. Unsecured personal loans offer flexibility without using your home as collateral. Government-backed loans, like FHA Title 1, can also be available for specific projects.

Qualifying for financing involves several factors. Lenders prioritize a good credit score, reflecting your repayment reliability. Your debt-to-income (DTI) ratio, comparing debt to income, is also crucial. Stable and verifiable income is necessary to demonstrate your ability to repay. Prepare documentation like pay stubs and tax returns. Before applying, define your project and budget, and compare offers from multiple lenders to secure the best terms. Understanding these options and qualifications will empower you to finance your home improvement dreams effectively.